The Marcos administration on Wednesday welcomed S&P Global Ratings affirmation of the Philippines’ ‘BBB+’ long-term and ‘A-2’ short-term sovereign credit ratings, manifesting investors’ confidence on the Philippine economy’s macroeconomic fundamentals.

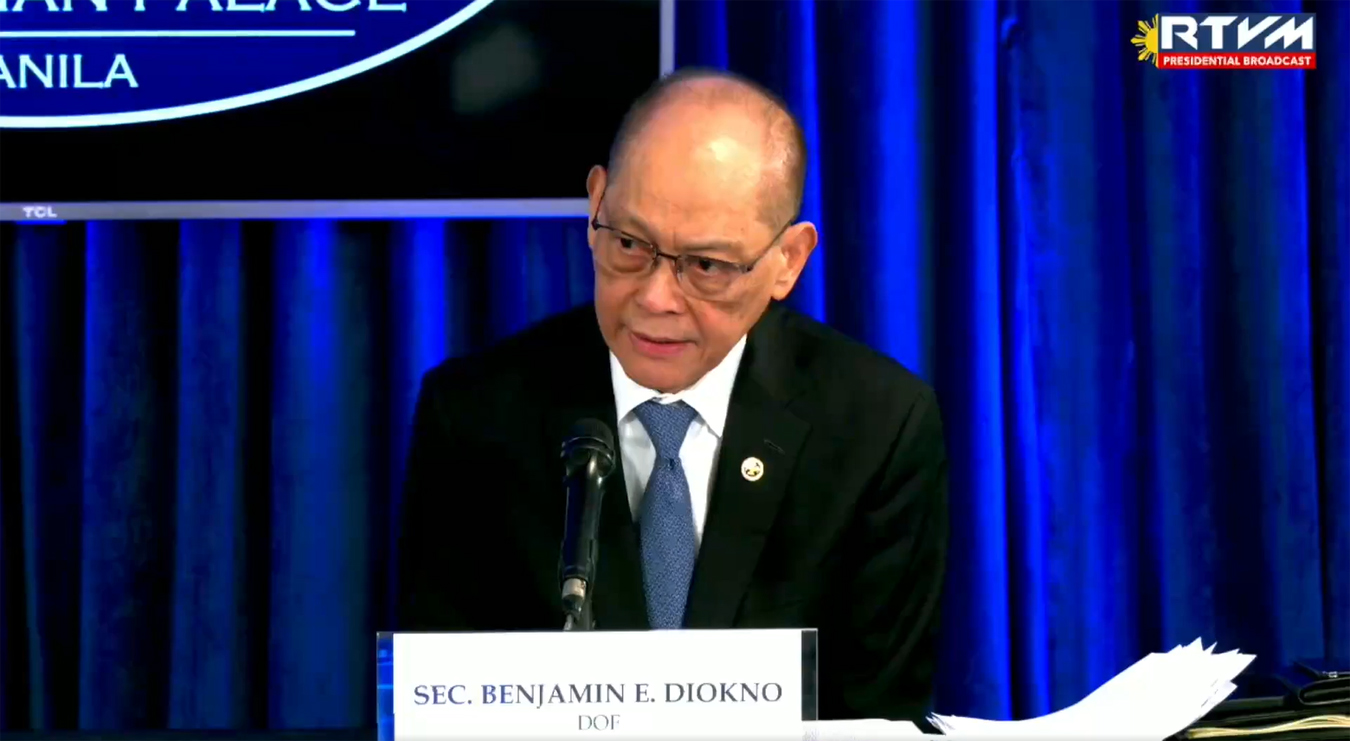

“That’s an accomplishment of the PBBM (President Ferdinand ‘Bongbong’ R. Marcos Jr.) administration. In a sea of downgrades, the international rating agencies continue to affirm their confidence on the Philippine economy’s macroeconomic fundamentals,” Finance Secretary Benjamin Diokno said in a statement.

“We continue to pursue the Road to A under President Marcos Jr’s administration.”

US-based S&P Global credit rating agency affirmed ‘BBB+’ long-term and ‘A-2’ short-term sovereign credit ratings on the Philippines, citing stable outlook on the country’s sustained economic recovery and decline in fiscal deficits over the next two years.

“On Nov. 28, 2023, S&P Global Ratings affirmed its ‘’BB+’ long-term and ‘A-2’ short-term sovereign credit ratings on the Philippines. The outlook on the long-term rating remains stable,” S&P Global said on its recent rating on the Philippines.

“The stable outlook reflects our expectation that the Philippine economy will maintain healthy growth rates and the fiscal performance will materially improve over the next 24 months,” it said.

S&P said the ratings on the Philippines reflect the country’s above-average economic growth potential, which should drive constructive development outcomes and underpin broader credit metrics.

The ratings benefit from the Philippines’ strong external settings, with the country’s low gross domestic product (GDP) per capita relative to other investment-grade sovereigns and evolving institutional settings temper these strengths.

“The government’s fiscal and debt settings have deteriorated due to the economic fallout from the pandemic and the associated extraordinary policy responses. Fiscal buffers built through a long record of prudence before the pandemic have thinned, but we expect a consolidation as the economy recovers,” S&P said.

The credit rating agency also said that although there is near-term risks to growth, the Philippines’ economic outlook remains solid for the longer term, in which, it expects a real GDP growth of 5.4 percent this year.

It also said that the ongoing reform on the business, investment, and tax fronts should benefit growth over the next three to four years.

“We expect the Marcos administration to continue to adhere to the well-established medium-term fiscal framework that has delivered constructive development outcomes,” it added. PND